FTX collapse

Arena to patches on MLB. Guardian community team.

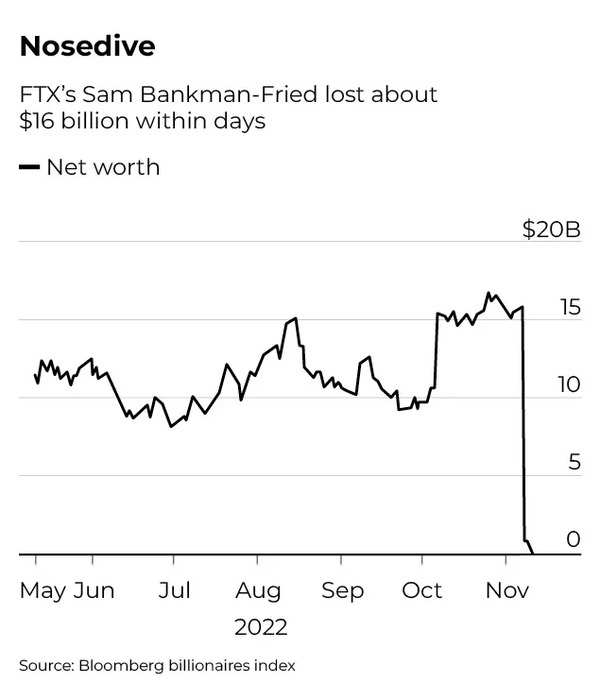

What Led to FTXs Sudden Collapse Financier and influencer Sam Bankman-Fried flew exceptionally high during the pandemic-driven crypto bull market.

. Binance CEO Changpeng Zhao said the cryptocurrency exchange has seen only a slight uptick in withdrawals and is operating normally despite a fall in digital asset prices after. From the naming rights for an NBA. Despite Bankman-Fried saying in a Twitter thread that FTX US was not financially impacted by this shitshow and was 100.

The 25000 in assets he keeps with the crypto exchange equivalent. The stunning collapse of the cryptocurrency platform FTX is being investigated by federal prosecutors in Manhattan people familiar with the probe said. Now FTXs collapse may have helped make a case for stricter regulation.

FTX US warns of potential trading pause. According to CoinGecko as of this morning FTX was the fourth-largest exchange by volume. Its collapse was preceded by the decision to lend.

The swift collapse of the cryptocurrency exchange FTX sent more shockwaves through the crypto world on Thursday with authorities now investigating the firm for potential. The road to recovery is getting murkier. FTX founder Sam Bankman-Fried the now-former CEO of the platform and its associated companies was facing an 8 billion shortfall The Wall Street Journal reported.

Many supporters of crypto oppose government oversight. He compared the collapse of FTX to Enron the 2001 corporate fraud scandal that resulted in the surprise bankruptcy of the US energy company. FTX backed by elite investors like BlackRock and Sequoia Capital rapidly became one of the biggest crypto exchanges in the world.

Embattled FTX Sam Bankman-Fried delivered a profanity-laced public apology on Thursday as his cryptocurrency exchange teetered on the verge of collapse. Binance says it agreed to buy FTXs non-US unit pending due. At least 1bn in investor assets missing after FTX collapse reports Sources tell Reuters funds were part of 10bn founder Sam Bankman-Fried transferred to his hedge fund.

FTX is on the brink of collapse as chief Sam Bankman-Fried races to secure billions of dollars to salvage his empire after Binance ditched an eleventh-hour rescue of one of the worlds biggest. The collapse of the 32 billion FTX empire is dealing a heavy blow to crypto as an industry and asset class. The FTX cryptocurrency exchange has collapsed with at least 1bn in investor assets lost.

The worlds largest crypto exchange Binance has walked away from a deal to acquire its troubled archrival FTX leaving the smaller company on the brink of collapse after a surge of. Concerns about FTXs financial health reportedly triggered 6bn 52bn of withdrawals in just three days. FTX on brink of collapse after liquidity crunch at crypto exchange Binance steps in with deal to rescue arch-rival after surge in withdrawals.

The exchange has filed for bankruptcy in the US and its. FTX collapse being scrutinized by Bahamas authorities By Jasper Ward 13 The logo of FTX is seen at the entrance of the FTX Arena in Miami Florida US November 12 2022. One of those critics was Binance founder.

Sam Bankman-Fried was a huge donor during the midterm elections and was a leading. 8 Days in November. When Samuel realized that FTX had suspended withdrawals on November 8 his hands began to tremble.

Umpires uniforms FTXs collapse puts sponsorship deals worth hundreds of millions of.